Does a Metal Roof Really Lower the Cost of Home Insurance?

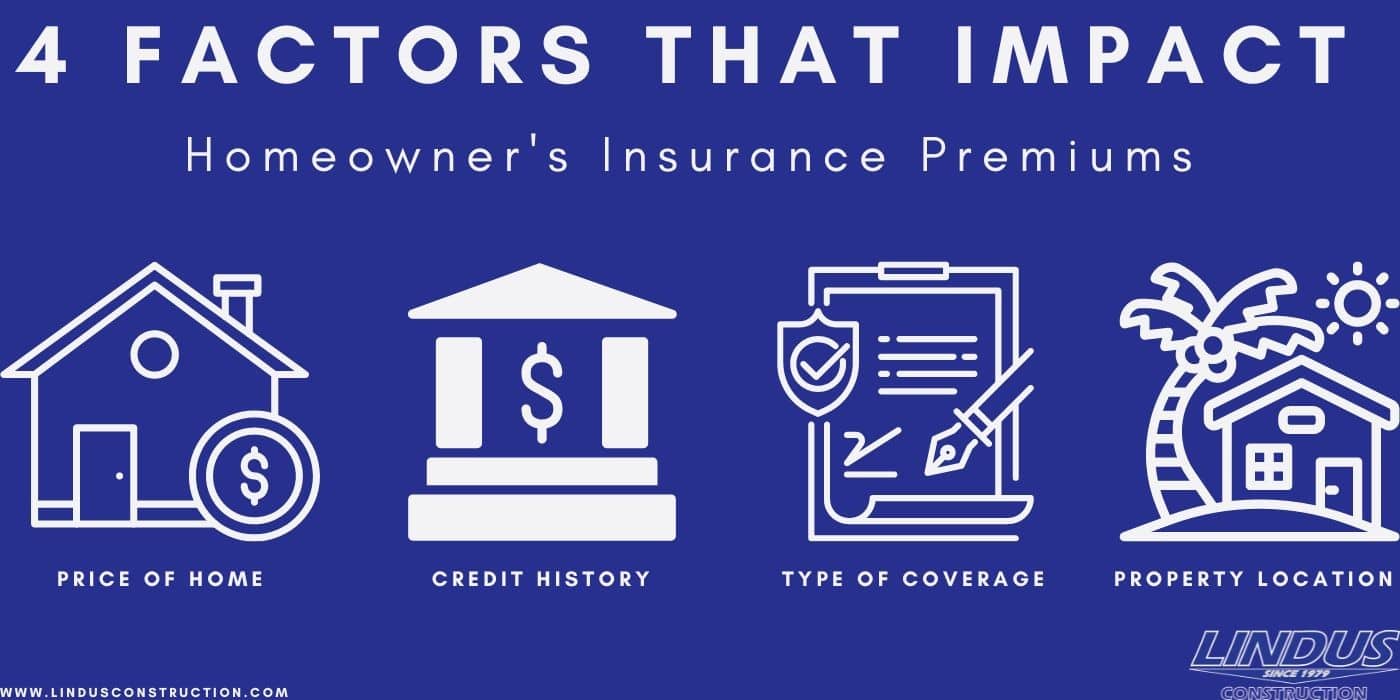

Your homeowners insurance rates can depend on an array of factors. Here are four of the most common ones.

Savvy owners know there are steps they can take to lower their homeowner’s insurance rates. And if you’re one of those, you may have heard rumors about roofing and its relationship to premium costs. Well, it’s true that the installation of long-lasting roofing materials can help you save money on home insurance. That’s because the risk of an insurance company having to cover a roof replacement due to storm damage is minimal. In fact, insurance companies cover metal roofs and often offer a discount for their installation. Here’s what you need to know.

Does A Metal Roof Always Lower Your Insurance?

Bear in mind that metal roof insurance may not be lower than other roofing materials. However, companies like Progressive do consider the type of roof material you have and admit that there is often a metal roof insurance discount. Before you pull the trigger on a new roof installation, verify how much a metal roof saves on insurance with your agent.

Homeowners Insurance And Metal Roofs

There are many reasons a new metal roof often qualifies for an insurance discount. Here are the most cited:

Longevity

Metal roofs can last 50 years or more. This makes them more appealing than cedar shake roofs which have limited lifespans. Metal roofing also has warranties that state they will not warp, crack, chip, or peel.

Durability

A home’s roof is subject to Mother Nature. Metal roofing does an excellent job of holding up to extreme heat and cold temperatures. Its properties allow it to shed rain, snow, and ice dams-and even offer resistance to high winds. Metal roofing has the highest possible impact-resistance rating, making them unlikely to suffer hail damage. All of these factors impact insurance companies’ ability to offer discounts for metal roofing.

Bonus read: Find A Roofing Contractor to Help with Your Hail Damage Roof Insurance Claim

Fire Resistance

Another way a metal roof can lower your insurance is through fire resistance. This material won’t combust under fire, and while over time, it can melt, but few fires are hot enough to make this happen. If you’re considering a metal roof, opt for one that have a Class A rating, which is the best fire protection.

Myths About Metal Roofs

Myths About Metal Roofs

Even after finding out the answer to whether a metal roof can lower the cost of home insurance is “yes” some homeowners are still deterred because of metal roofing myths and online misinformation.

One common misconception is that metal is louder than asphalt roofing. In fact, if there is proper attic insulation, a metal roof can prevent loud noises, even during storms.

Another common misconception is that metal roofs are are more likely than other materials to encounter a lightning strike-which is also not true. If a lighting strike does happen, the roof is more protected from a fire than a cedar cedar shake or asphalt roof would be.

A Final Word On Metal Roof Insurance

To learn more about homeowners insurance and metal roofs, it’s wise to consult your agent. They can guide you on the roofing criteria needed to lower your insurance rates. Your insurance agent can also provide details regarding a metal roof insurance discount and give names of reputable roofers.

If you’re looking for a reliable roofing contractor, we have decades of experience along with offering a lifetime workmanship guarantee. If any of our installations fail, rest assured, the replacement will be covered at no cost to you. Learn why many homeowners choose Lindus Construction for their metal roof installations and contact us today if you have any questions.